How to Choose the Right Side Hustle in 2025

The side hustle matrix: how to compare models, avoid mistakes, and choose right

Why this matters now

Starting a side hustle has become almost mainstream in 2025. Rising living costs, inflation pressures, and a cultural shift toward flexible work have pushed millions of people to look for new income streams. Some do it to pay bills. Others want to test entrepreneurial skills without quitting their job. A few see it as a way to build long-term independence.

But outcomes vary widely. According to the Bankrate 2025 Side Hustle Survey, 27% of U.S. adults report having a side hustle. The average monthly income is $885, yet the median is just $200. This means most side hustlers are earning only a few hundred dollars, while a small group makes thousands. Only 14% earn more than $1,000 per month, while 58% earn at least $100 per month (source: Bankrate 2025 Side Hustle Survey).

This matters because many people start with the wrong expectations. They copy what’s trending on social media — dropshipping, crypto, YouTube — and quit after a few months of frustration. Others overlook “boring” but reliable models like tutoring or reselling, which generate cash quickly.

Key takeaway: The best side hustle isn’t the hottest trend, but the one that fits your skills, resources, and tolerance for complexity.

The first big question: cash-first or asset-first?

Before comparing categories, ask yourself: do you need cash quickly, or do you want to build something that compounds?

Cash-first hustles: Freelancing, tutoring, delivery driving, or reselling. You trade time for money, which is perfect if you need income in the next few weeks. The downside: income is capped by your hours.

Asset-first hustles: eBooks, websites, courses, memberships, or software. These start slow but compound over time, and eventually decouple income from hours.

The creator and content economy exceeded $200 billion in 2024 (KPMG report, 2025), showing the size of asset-first opportunities. But most creators start part-time, alongside a job. That highlights the patience and consistency required.

Quick self-check before choosing:

Do you need money in the next 30–60 days? → Lean cash-first.

Can you handle tools, processes, maybe even a small team? → Asset-first or brand-building.

Do you own an audience, or will you rely entirely on platforms?

Can you invest 10+ hours per week? That’s the typical commitment side hustlers report.

💡 This article is part of Side Hustles & Businesses — a series of practical guides to help you start and grow your next project.

If you’re reading this, you might also want to check out:

✉️ Subscribe to the newsletter to stay updated on what’s working in digital business.

A simple 2×2 matrix to compare apples to apples

Lists of “best side hustles” mix incomparable things: driving for Uber, publishing an ebook, or running a Shopify store. A framework is needed.

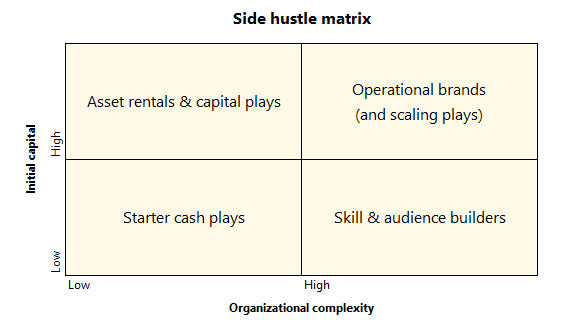

That’s why we use a 2×2 matrix based on:

Initial capital: How much money you must put in before earning your first dollar. For some hustles this is negligible — signing up on a freelancing site costs almost nothing. For others, like renting property or launching an e-commerce brand, you may need thousands upfront for inventory, licenses, or marketing. Importantly, “capital” is not only cash but also tools and infrastructure — for example, a designer’s laptop or a musician’s equipment.

Organizational complexity: How difficult it is to keep the engine running. A solo freelancer manages only their own time. A YouTube creator manages editing, thumbnails, distribution, and often collaborators. A marketplace seller must handle suppliers, shipping, customer service, and ad campaigns. Complexity grows as you add resources (people, contractors, or technology), processes (ops, fulfillment, support), and infrastructure (software, logistics, finance).

Together these two axes form the side hustle matrix:

The four quadrants

Starter cash plays – Quick to start, low setup, switchable.

These are the simplest entry points: freelancing gigs, tutoring, ride-sharing, or basic reselling. They require almost no upfront capital and can be turned on or off at will.

Pros: immediate dollars, low barrier, high flexibility.

Cons: limited scalability, your time sets the ceiling.

Skill & audience builders – Based on skills, content, or communities.

These models rely more on expertise, creativity, or consistent publishing than money. Examples: digital products, podcasts, communities. They start slowly but compound as skills improve and audiences grow.

Pros: minimal upfront costs, scalable potential.

Cons: slow to ramp, requires consistency and patience.

Asset rentals & capital plays – Physical or digital assets generating income.

Here, money or assets do the heavy lifting: Airbnb rentals, car-sharing, stock photo libraries, or IP licensing. The operation is often straightforward, but access depends on capital or ownership.

Pros: semi-passive once set up, relatively simple operations.

Cons: requires capital, utilization risk (an empty Airbnb or unsold stock photo earns nothing).

Operational brands (and scaling plays) – Hustles that resemble companies.

The final quadrant covers side hustles that evolve into full businesses: e-commerce stores, micro-SaaS, scaled POD brands, or niche marketplaces. These can start small but eventually require structured teams, systems, and capital.

Pros: highest upside, defensible, can grow into standalone companies.

Cons: management-heavy, capital-intensive, higher risk.

Note: many models from the other quadrants can migrate here once scaled. A newsletter can grow into a media company, freelancing into an agency, Etsy into a brand.

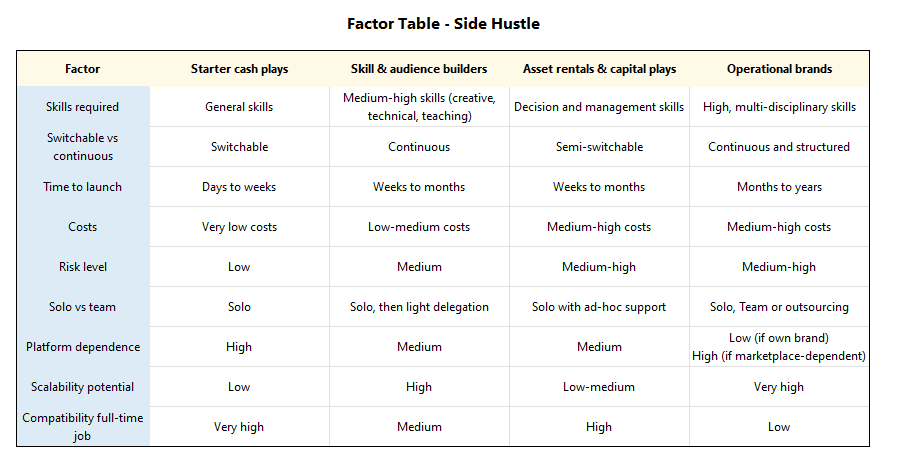

Factors you must also consider

The 2×2 matrix helps you see the big picture, but it doesn’t capture every variable. Even within the same quadrant, two side hustles can feel completely different. That’s where a Factor Table comes in: it’s a checklist of the dimensions you should weigh before committing. Think of it as a “second filter” once you’ve narrowed down your options.

Here are the most important factors to consider:

Here’s how to read it:

Skills required

Starter cash plays typically rely on general skills anyone can apply — driving, tutoring, or basic freelancing. Skill & audience builders demand more advanced abilities such as writing, design, or teaching. Asset rentals and capital plays are less about technical know-how and more about decision-making and resource management. Operational brands, finally, require multi-disciplinary skills spanning product, marketing, logistics, and leadership.Switchable vs continuous

Some hustles, like gig apps or short freelance projects, are “switchable” — you can pause and resume with little consequence. Others, like audience-based businesses or e-commerce, require continuous presence. Asset rentals fall in between: a car on Turo can be listed only when available, but an e-commerce brand has no such pause button.Time to launch

If speed matters, starter cash plays can get you earning within days. Skill-driven and asset-based models usually take weeks or months to set up, as they involve creating content, acquiring assets, or building an audience. Operational brands are the slowest to ramp up, often requiring months to start.Costs

Most starter plays cost little beyond time. Skill & audience models remain relatively affordable but may involve software subscriptions or tools. Asset rentals and operational brands require far more upfront spending, whether on inventory, property, or advertising.Risk level

Risk correlates with both costs and complexity. Low-capital hustles carry little downside beyond time invested. Asset-heavy or brand-based plays involve medium to high risk: a failed inventory purchase or underutilized asset translates into real losses.Solo vs team

Many hustles can be started alone. Over time, however, skill-based models may need light delegation (e.g., an editor for a podcast), and asset plays sometimes require ad-hoc support (e.g., property management). Operational brands often move fastest when built with teams or outsourcing, since functions like logistics and marketing can’t always be handled by one person.Platform dependence

Gig workers and freelancers rely heavily on platforms like Uber, Fiverr, or Upwork. Skill builders enjoy more autonomy if they grow owned channels such as newsletters. Asset rentals and capital plays depend on distribution platforms but to a lesser extent. Operational brands can be either highly independent (own e-commerce site) or deeply dependent (Amazon FBA).Scalability potential

Starter cash hustles rarely scale beyond the hours you can sell. Skill builders, on the other hand, can scale significantly once content or products are created. Asset rentals scale modestly — limited by capital and asset availability. Operational brands offer the highest scalability, but only if processes, marketing, and capital align.Compatibility with a full-time job

Some hustles fit neatly around a 9–5. Starter plays are the most compatible, since they can be turned on or off. Skill-based models sit in the middle: they require regular attention, but can often be done on evenings or weekends. Asset rentals are relatively flexible if capital is available. Operational brands, by contrast, can quickly overwhelm and conflict with full-time employment.

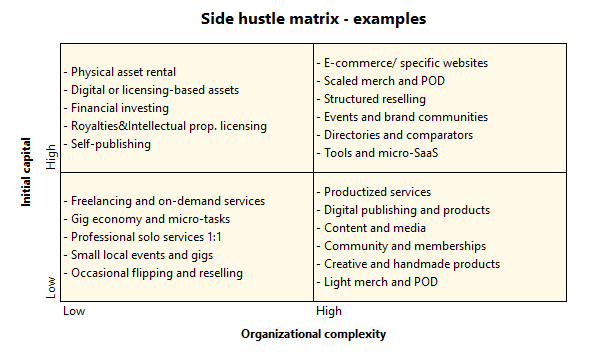

Mapping categories into the matrix

Here’s how the most common side hustles map into the matrix.

Starter cash plays

These prioritize immediacy: fast money, low scalability.

Freelancing and on-demand services: Writing, design, tutoring. Platforms like Upwork and Fiverr make entry easy. But income is uneven: while some earn $50K+, surveys show that over 95% of sellers make under $500/month.

Gig economy and micro-tasks: Driving for Uber, delivering with DoorDash, or micro-tasks on Amazon Mechanical Turk. Pay varies: U.S. Uber drivers typically earn $20–33/hour before expenses. Net income depends heavily on location and costs.

Professional solo services 1:1: Coaching, consulting, or teaching. For example, an English tutor selling a 10-session package or a fitness instructor running structured programs.

Small local events and gigs: Paid workshops, pop-ups, or talks. Good for testing niches and capturing leads.

Flipping and reselling: Buying undervalued items and reselling on eBay or Facebook Marketplace. Simple to start, harder to scale without logistics.

Skill & audience builders

These models compound over time. They rarely pay fast, but grow if you stay consistent.

Productized services: Fixed packages like “logo design with 3 revisions” or “6-week yoga program.” Easier to sell repeatedly.

Digital publishing and products: Ebooks, templates, online courses. Platforms like Gumroad and Teachable streamline distribution.

Content and media: Blogs, newsletters, podcasts, YouTube channels. The creator economy exceeded $200B in 2024 (KPMG, 2025). Growth is slow but compounding.

Community and memberships: Paid groups on Discord, Slack, or Circle. Require ongoing value to retain members.

Creative and handmade products: Sold on Etsy, which processed $12.6B in annual merchandise sales in 2024. The opportunity is real, but competition is fierce.

Light merch and POD: Print-on-demand T-shirts or mugs. Barriers are low, but scaling requires marketing.

Asset rentals & capital plays

These use capital or assets to generate income.

Physical asset rental: Homes (Airbnb), cars (Turo), or tools. Attractive but require capital.

Digital/licensing-based assets: Stock photos, music libraries, or domain names. Passive, but distribution is key.

Financial investing: Stocks, REITs, crowdfunding. Less “hustle,” more investment.

Royalties & IP licensing: Monetizing songs, patents, or designs. Attractive if you already hold assets.

Self-publishing: Ebooks or print via KDP. But note: royalty rates changed in June 2025, lowering payouts for some print tiers.

Websites: Building or acquiring niche sites, monetized via ads or affiliates. SEO heavy, but scalable.

Operational brands (and scaling plays)

These resemble small companies: higher risk, higher upside.

E-commerce or niche sites: A Shopify store or vertical marketplace. Requires inventory, logistics, and marketing.

Scaled merch and POD: From hobby T-shirts to real apparel brands with ad budgets.

Structured reselling: Professional operations with sourcing and warehousing.

Events and brand communities: Conferences, cohort-based courses, or recurring programs.

Directories and comparators: Niche platforms monetized via ads or leads. SEO-driven.

Tools and micro-SaaS: Software solving niche problems. Attractive margins, but dev and support matter.

Residual scaling plays: Many models from other quadrants can evolve here — a newsletter becomes a media company, freelancing becomes an agency.

Managing expectations

Side hustles are often presented as “easy passive income.” The reality: most require consistent effort, and the biggest challenge is distribution.

More hustles fail because nobody finds them than because the product was poor.

Common mistakes to avoid:

Starting what’s trendy instead of what fits your resources.

Expecting fast passive income from models that need work.

Underestimating distribution — getting customers is harder than making products.

A useful mindset: treat your hustle as an experiment. You’re testing whether your skills, capital, and channels can meet demand.

What you should do next

Short answer: Choose based on your needs, not on trends.

Need money fast? → Starter cash plays.

Have skills and patience? → Build digital products or communities.

Have capital? → Asset rentals, websites, or licensing.

Want to build a company? → Operational brands.

Some models are simple to test, others require years of effort. Success depends on your expectations, commitment, and tolerance for risk.

FAQ

What is the most profitable side hustle?

Content/media, digital products, and operational brands have the highest scalability. Profit depends on fit and distribution.

What’s the cheapest side hustle to start?

Freelancing, tutoring, or gig apps. Almost no capital required.

What side hustle can I start with no skills?

Gig apps or basic reselling. Growth is capped, but they’re entry points.

What’s the easiest?

Gig apps and freelancing are easiest to start, but rarely scale well.

What’s the most sustainable?

Skill- and asset-based hustles, because they compound over time.

Can I do it from home?

Yes. Publishing, websites, SaaS, memberships, and many asset plays are fully remote-friendly.

What are the common mistakes?

Chasing trends, underestimating distribution, and misjudging timelines.

How long until I make money?

Cash hustles: days. Publishing: weeks. Brands: months or years.

Can a side hustle replace a full-time job?

Possible, but rare. Data shows most hustlers earn <$500/month. Treat it as supplemental unless you scale.

Which side hustles fail most often?

On-demand gigs rarely fail but cap earnings. Asset and content plays fail most often at the distribution stage.

Can AI tools make side hustles easier?

Yes. AI accelerates content creation, design, and automation. But tools don’t replace distribution or demand.

Final takeaway

There is no universal “best” side hustle. The right choice depends on your capital, complexity tolerance, and goals.

The matrix, factor table, and category mapping give you a structured way to evaluate options realistically.